Introduction to MGAs

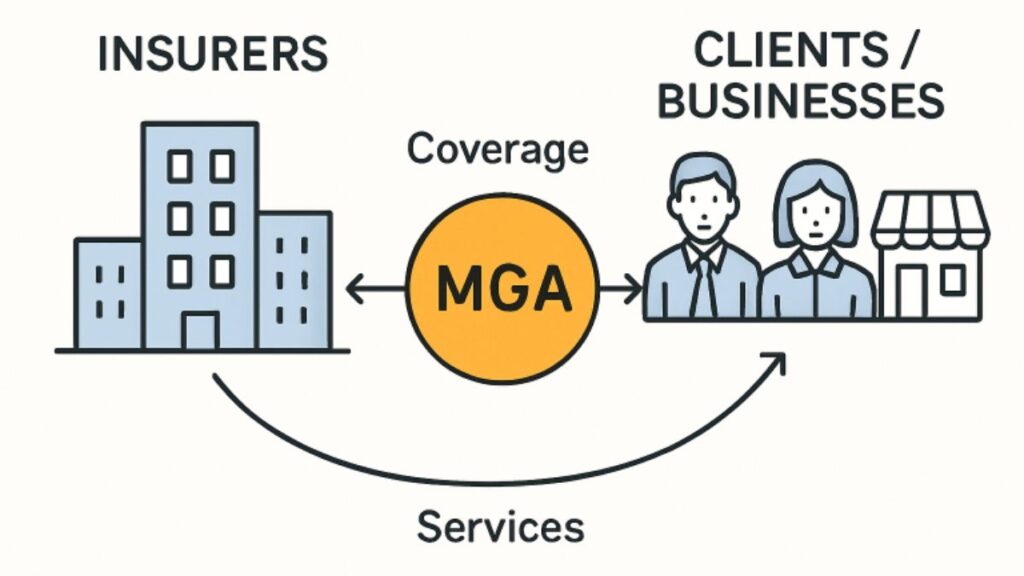

Managing General Agents (MGAs) have carved out a distinct and vital role within the insurance ecosystem, serving as intermediaries between insurance carriers and policyholders. What makes MGAs unique is the delegated authority they receive from insurers, which empowers them to assess risks, underwrite policies, and sometimes manage claims processing. This structure provides access to tailored insurance products that may not be available through traditional carriers.

As the insurance marketplace grows increasingly complex and competitive, MGAs are stepping up to fill gaps and deliver expertise that benefits both insurers and clients. Not only do they bring specialized knowledge to niche markets, but they also drive innovation in underwriting and distribution. To learn more about the specific role of MGAs in the industry, visit this helpful resource on what is an MGA.

The growth of MGAs is symptomatic of broader shifts in the financial and risk management landscape. Insurers face mounting pressure to reduce overhead and react swiftly to emerging risks, which has led to an increase in the delegation of functions to MGAs. Consequently, MGAs are uniquely positioned to blend agility, technical know-how, and customer responsiveness for maximum benefit.

The business model of MGAs is also supported by advances in technology, which empower them to provide accurate, fast, and scalable solutions for both established and emerging insurance needs. With clear advantages in flexibility, speed, and niche knowledge, MGAs continue to outperform traditional insurance providers in select markets.

Key Functions of MGAs

MGAs offer a comprehensive portfolio of services that extend well beyond simple policy sales. Their delegated authority from insurance carriers allows them to perform essential functions, making them invaluable partners for carriers and brokers alike:

- Underwriting Authority: MGAs commonly have the authority to bind coverage, set premium pricing, and determine terms and conditions on behalf of their partnered carriers.

- Risk Assessment: They bring specialized expertise to evaluate risks and exposures, ensuring policies are accurately priced and tailored to the insured’s profile.

- Claims Management: While not universal, some MGAs offer claims handling services, providing expedient settlements and efficient customer service for covered losses.

- Product Development: By leveraging deep sector knowledge, MGAs frequently develop tailored products designed for specific industries or emerging risks.

Their hands-on, adaptable approach means MGAs can quickly address unique client needs and market shifts, delivering insurance solutions that traditional carriers may be slower or less equipped to offer.

Growth and Market Impact

MGAs are at the forefront of industry growth. In 2024, MGAs in the United States generated over $114 billion in direct written premiums, a 16% increase over the prior year. This far outpaces the overall property and casualty insurance industry, which registered roughly 10% growth, underscoring the growing influence and demand for MGA services.

The market impact of MGAs is particularly notable in sectors such as cyber insurance, professional liability, and emerging risk classes. Their agility enables them to identify new market opportunities and fill insurance gaps faster than many traditional carriers. This is a core reason why many insurers opt to partner with MGAs rather than build specialized distribution and underwriting platforms internally.

Technological Advancements

Technology is a critical driver of the modern MGA model. Artificial intelligence, machine learning, and sophisticated analytics platforms have empowered MGAs to automate underwriting processes, assess risks with greater accuracy, and offer predictive modeling for loss control. Automated workflows expedite the issuance of policies and claims handling, benefiting both carriers and insureds.

Digital transformation has also enhanced compliance, reporting, and data management for MGAs, leading to more transparent and robust relationships with mainstream insurers. As technology evolves, MGAs embracing digital solutions remain competitive and responsive—an essential advantage as risk environments shift rapidly.

Specialization and Niche Markets

The value proposition of MGAs is particularly strong in niche and specialized markets. Many MGAs specialize in areas such as aviation, marine, construction, and professional liability insurance. By cultivating deep industry knowledge, they’re able to:

- Identify and address unique risks that fall outside the traditional insurers’ comfort zone.

- Craft bespoke policy wordings that reflect client realities and industry-specific exposures.

- Stay informed about emerging threats, industry regulations, and technological advancements that impact risk.

This specialization not only drives innovation but also allows MGAs to fill significant coverage gaps for businesses seeking non-standard or evolving insurance solutions.

Regulatory Considerations

Regulatory oversight is intensifying as MGAs command a larger market share and shoulder greater responsibility in insurance distribution. Compliance with licensing, consumer protection laws, and transparency standards is a top priority for MGAs seeking to build and retain trust with clients and insurers. Increasing reporting requirements and best-practice governance are central to upholding reputation and stability in this growing sector.

Regulatory bodies are particularly interested in how MGAs manage delegated authority, customer data, and solvency risk frameworks. MGAs that adopt a proactive and transparent approach to compliance are best positioned to thrive amid rising governance expectations.

Challenges and Opportunities

Despite impressive growth, MGAs also face significant challenges:

- Market Competition: As more entrants flood the MGA space, standing out requires continuous investment in innovation and client services.

- Regulatory Compliance: MGAs must keep pace with a rapidly evolving compliance landscape, adapting their practices and technologies as necessary.

- Technological Change: Ongoing investment in AI, automation, and digital infrastructure is necessary to stay ahead of risks and market trends.

However, these challenges also bring unparalleled opportunities. MGAs willing to adopt advanced technologies, focus on underserved markets, and strengthen transparency can solidify long-term industry leadership and loyalty.

Conclusion

Managing General Agents are indispensable partners in the insurance value chain—delivering flexibility, expertise, and innovation to insurers and clients alike. Their rapid growth is a direct result of embracing advanced technology, serving specialized and emerging markets, and adapting quickly to changing demands. As the insurance industry continues to evolve, MGAs are poised to remain agile leaders in delivering the personalized, effective solutions required in today’s dynamic risk landscape.